Total margin formula

Total Contribution Margin 1000000 650000. The final step is to calculate the marginal cost by dividing the change in total costs by the change in quantity.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Next the change in total costs and change in quantity ie.

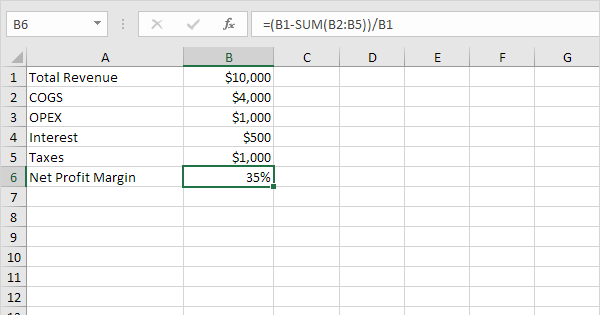

. The total already exists in the named range total C15 which contains a formula based on the SUM function. Company XYZ operates at a 30 net margin meaning that 030 of every dollar earned in revenue ends up. To calculate profit margin as a percentage with a formula subtract the cost from the price and divide the result by the price.

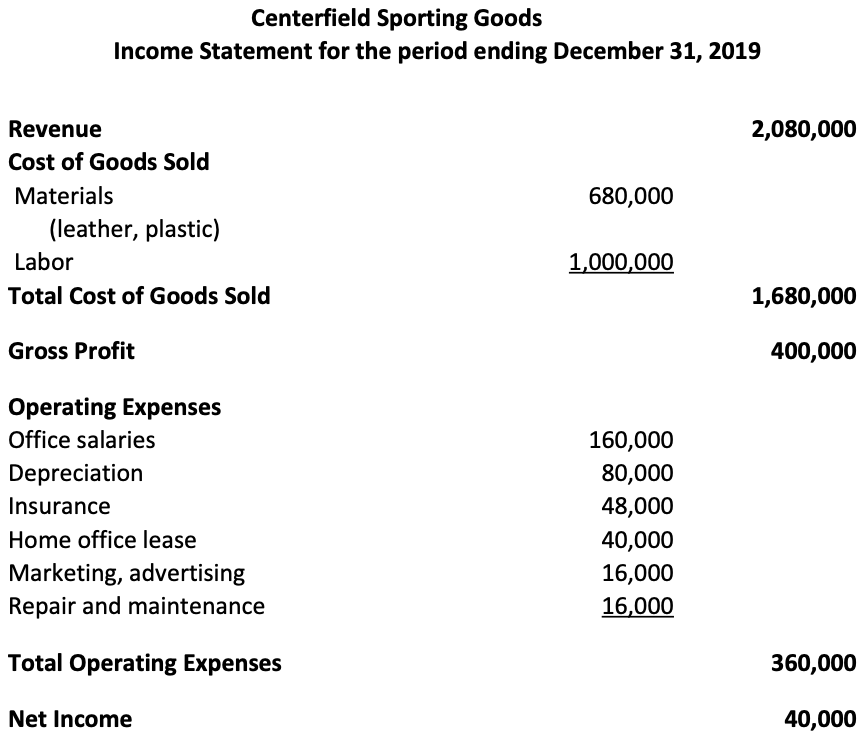

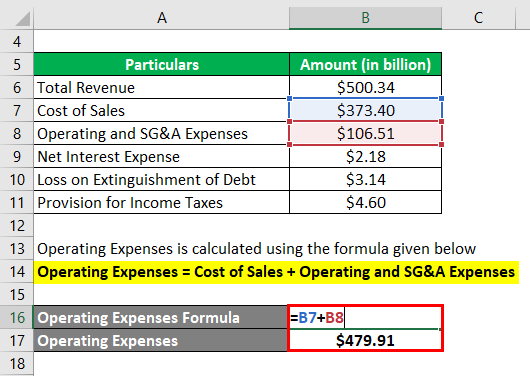

The Gross Profit Margin shows the income a company has left over after paying off all direct expenses related to manufacturing a product or providing a service. Gross profit percentage formula Gross profit Total sales 100. This formula is used when you dont have enough information about a.

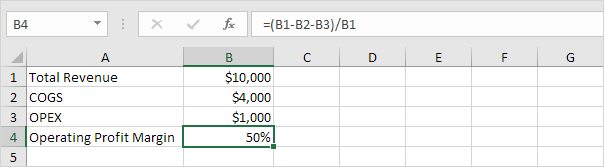

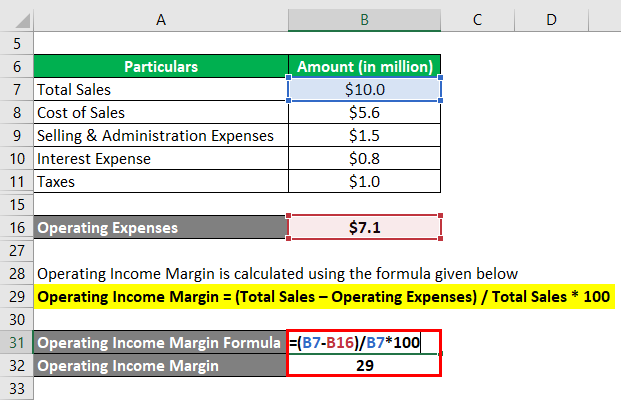

In other words given that we know the total is 1945 and. Using this information and the formula above we can calculate Electronics Company XYZs operating margin by dividing 4000 operating earnings by its 30000 revenue. Understanding Margin of Safety.

In this example the goal is to work out the percent of total for each expense shown in the worksheet. In cost-volume-profit analysis a form of management accounting contribution marginthe marginal profit per unit saleis a useful quantity in carrying out various calculations and can be used as a measure of operating leverageTypically low contribution margins are prevalent in the labor-intensive service sector while high contribution margins are prevalent in the capital. The numerator of the formula ie contribution margin can be calculated using simple contribution margin equation or by preparing a contribution margin income statement.

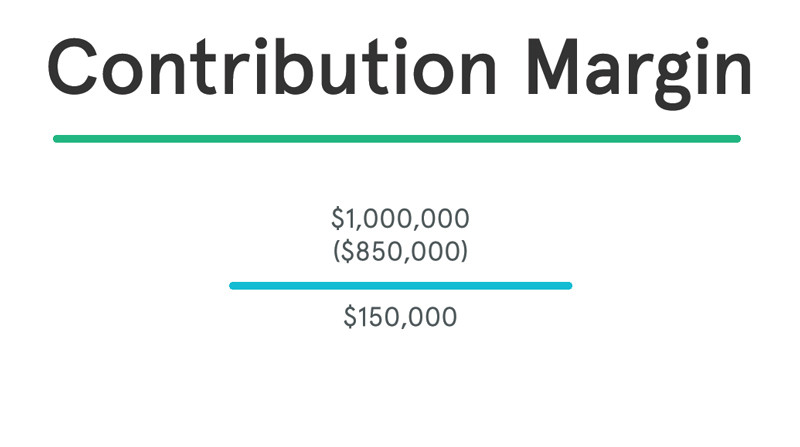

The total sales revenue of Black Stone Crushing Company was 150000 for the last year. As mentioned above the contribution margin is nothing but the sales revenue minus total variable costs. More from Cost volume and profit relationships explanations.

Gross profit margin shows how efficiently a company is running. Sales - Total Expenses Revenue x 100. Total Contribution Margin 350000.

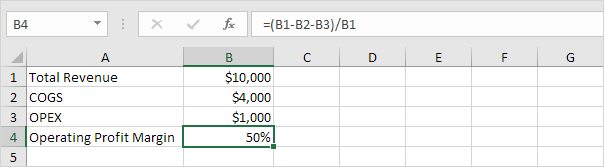

The profit margin formula is. In the example shown the formula in cell E5 is. See an example in Excel here.

Here is the formula for contribution margin ratio CM ratio. It is equal to contribution margin divided by total sales revenue and the formula or equation can be written as follows. The formula to calculate gross margin as a percentage is Gross Margin Total Revenue Cost of Goods SoldTotal Revenue x 100.

Thus the following structure of the contribution margin income statement will help you to understand the contribution margin formula. Net profit margin measures the profitability of a company by taking the amount from the gross profit margin and subtracting other operating expenses. Total contribution margin Number of units sold Contribution margin per unit 250000.

CM ratio Contribution margin Sales revenue. From a different viewpoint the margin of safety is the total amount of revenue that could be lost by a company. Total Costs Total Fixed Costs Total Variable Costs.

The formula to calculate gross margin is. The gross margin equation expresses the percentage of gross profit Percentage Of Gross Profit Gross profit percentage is used by the management investors and financial analysts to know the economic health and profitability of the company after accounting for the cost of sales. Firstly determine the cost of production which is fixed in nature ie.

Contribution Margin Contribution Margin per Unit No. This means that for every 1 in sales Electronics Company XYZ makes 013 in operating earnings. That cost which do not change with the change in the level of production.

The formula for total cost can be derived by using the following five steps. Gross profit percentage formula Gross profit Total sales 100 read more the better the companys overall health and profitability. The net profit margin tells you the profit that can be gained from total sales the operating profit margin shows the earnings from operating activities and the gross profit margin is the profit remaining after accounting for the costs of services or goods sold.

In this example the goal is to calculate and display profit margin as a percentage for each of the items shown in the table. Gross margin is important because it is one of many vital metrics to build a strategic plan around. Slovins formula is used to calculate the sample size necessary to achieve a certain confidence interval when sampling a population.

Margin of Safety Formula. A sample size is a total number of data points collected in a study eg the number of responses to a single survey question. Margin of Safety MOS 1 Current Share Price Intrinsic Value For instance lets say that a companys shares are trading at 10 but an investor has estimated the intrinsic value at 8.

Gross margin Total revenue - COGSTotal revenue x 100. Profit margin formula measures the amount earned earnings by the company with respect to each dollar of the sales generated. The margin of safety is the difference between the amount of expected profitability and the break-even point.

It is determined by subtracting the cost it takes to produce a good from the total revenue that is made. The fixed and variable expenses data of the last year is given below. Using the net margin formula we divide the 30000 net profit by the 100000 total revenue to obtain our net margin percentage.

Knowing the gross margin helps a company to develop a competitive pricing strategy manage inventory. Some examples of the fixed cost of production are selling expense rent expense. Production volume must be tracked across a specified period.

The margin of safety formula is equal to current sales minus the breakeven point divided by current sales. Total Cost 38000 Explanation. Why is gross margin important to a company.

Total Cost 20000 6 3000. In other words given a price of 500 and a cost of 400 we want to return a profit margin. Taylor PhD is a professor of mathematics at Anderson University and the author of An Introduction to Abstract Algebra.

CM ratio total revenue cost of goods sold any other variable expenses total revenue. Total Contribution Margin is calculated using the formula given below. The contribution margin formula is practical and simple.

SUM C6C14. Example Calculation of Contribution Margin Ratio. There are two applications to define the margin of safety.

Excel Formula Get Profit Margin Percentage Exceljet

Operating Profit Margin Formula Calculator Excel Template

What Is Gross Margin Definition Formula And Calculation Ig Bank

Contribution Margin Ratio Formula Per Unit Example Calculation

What Is Gross Margin And How To Calculate It Article

Contribution Margin Ratio Revenue After Variable Costs

Profit Margin Formula And Ratio Calculator Excel Template

Gross Margin Definition For B2b Saas Kpi Sense

Profit Margin L Most Important Metric For Financial Analysis

Profit Margin L Most Important Metric For Financial Analysis

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Profit Margin Formula In Excel In Easy Steps

Gross Profit Margin Vs Net Profit Margin Formula

Gross Profit Margin Vs Net Profit Margin Formula

Margin Calculator

Profit Margin Formula In Excel In Easy Steps